In October 2021, Clio, the law practice management company, launched Clio Payments, native e-payments technology built into the Clio Manage law practice management platform — a launch that CEO Jack Newton described at the time as the company’s most important product release since its debut in 2008.

Today, in its first international expansion of the technology, Clio released Clio Payments to the Canadian legal market, enabling its customers there to offer their clients electronic payment options, including flexible payment schedules.

“Through our work with hundreds of thousands of legal professionals, we know that the most frequent point of friction in attorney-client relationships is collections,” Newton said in a statement announcing the launch. “Financial matters bear a heavy burden on firm operations, time and revenue.

“Bringing payments to the Canadian market has the potential to fundamentally change where legal professionals spend their time — and who can access legal services.”

Learn more about Clio Manage at the LawNext legal Technology Directory.

Incorporating e-payments natively within a practice management platform has multiple advantages for users, including making the process of accepting and tracking payments more seamless.

Since launching Clio Payments in the U.S. last year, over $1 billion in transactions have been processed through it, the company said. It plans to continue to expand the product to other countries.

According to Clio, most law firms in Canada accept only cash payments through certified checks, EFT direct deposits or the Interac payment system, and they manually record and handle trust payments, while more than 60% of Canadians pay for transactions generally using credit cards and 30% using debit cards.

Clio also sees its payment service, by offering flexible installment payments, as a way of closing the justice gap in Canada by enabling lower-income individuals to pay for legal help over time.

“Clients may find it difficult to pay the upfront litigation costs in one lump sum,” Newton said. “Clio Payments enables lawyers to break down payments into manageable installments, offering the flexibility clients may require.”

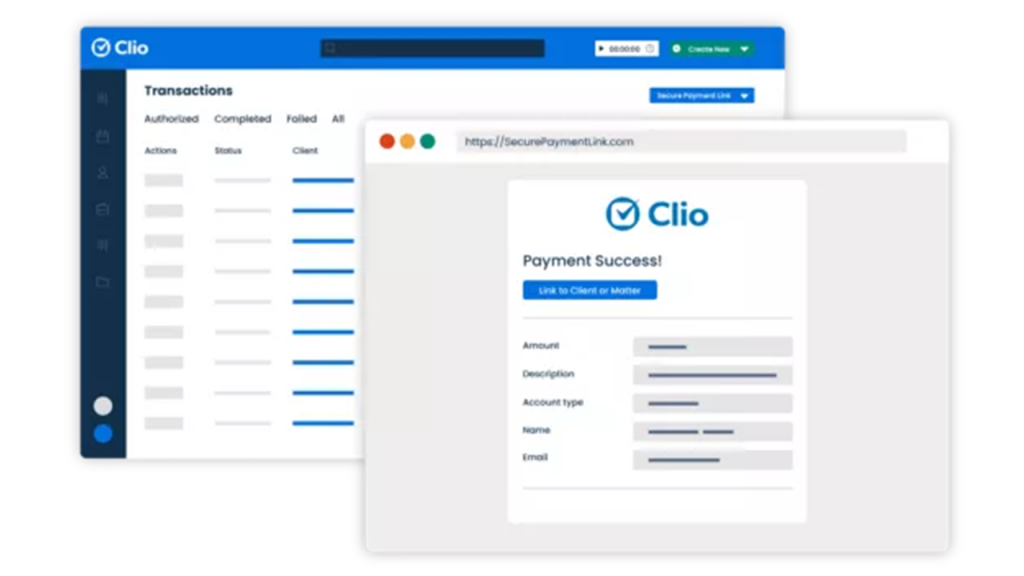

Using Clio Payments, when a lawyer sends an invoice, it includes a payment link. The link takes the client to a payment page, where the client can apply a payment of any amount. The client can store credit card information to simplify future payments.

When a client makes a payment, the payment shows up within seconds in Clio and is also synchronized to the user’s accounting platform.

As with any payment processor, firms using Clio Payments are charged transaction fees. I do not know if the fees are the same in Canada, but in the U.S., Clio Payments charges a single flat fee of 2.8% for all credit card types and a flat rate of $2 for check transactions.