TrustBooks, a cloud-based program originally designed to make trust accounting simple and foolproof for small and mid-sized law firms, has expanded its platform to also provide operating accounting, enabling law firms to manage both their operating and trust accounts within a single product.

I reviewed TrustBooks in 2016, describing it then as “trust accounting made simple and painless.” The product was cofounded in 2014 by Tom Boyle, a North Carolina CPA whose work with small law firms led him to conclude there had to be better software for lawyers’ trust accounting than QuickBooks or Microsoft Excel. Finding none, he developed his own.

“We’ve tried to be very simple,” Boyle told me in 2016. “We’ve taken the accounting language out of the mix. We let small firms get up and going without understanding complex accounting.”

Although the company continued to develop and enhance its trust accounting software since then, it also heard from its customers that they wanted the same kind of simplicity for managing their operating accounts, Boyle and cofounder Chad Todd told me during a demonstration yesterday.

“We have heard from thousands of attorneys that they love the simplicity we bring to trust accounting,” Todd said. “These same attorneys have been asking for a simple way to manage their operating accounts as well.”

Intuitive Simplicity

Based on the demonstration I saw yesterday, TrustBooks’ new operating accounting maintains the intuitive simplicity that it delivered for trust accounting. This is not intended to be a full-featured program designed for accounting professionals, but rather a simple-to-use product for lawyers to track their daily and monthly accounting.

The TrustBooks dashboard provides an at-a-glance overview of a firm’s trust and operating accounts. All activity for these accounts is tied to the matter, and the matter page is where users will spend most of their time in the program. From the matter page, a lawyer can manage all deposits, payments and reports, and perform three-way reconciliations of trust accounts.

To help ensure that users know which accounts they are working in, all account pages have either a green or blue background design. All green pages relate to trust accounts and all blue pages relate to operating accounts.

TrustBooks integrates with the practice management platform Clio, so that matters created in Clio and transactions recorded in Clio can be easily imported into TrustBooks.

TrustBooks also allows check printing, which Clio does not natively offer. That enables a lawyer to record a payment in Clio, import it into TrustBooks, and then print the check.

It also integrates with the electronic payments software LawPay to synchronize payments received there, and with your online banking accounts, to allow easy transfers of data and avoid duplicate data entry.

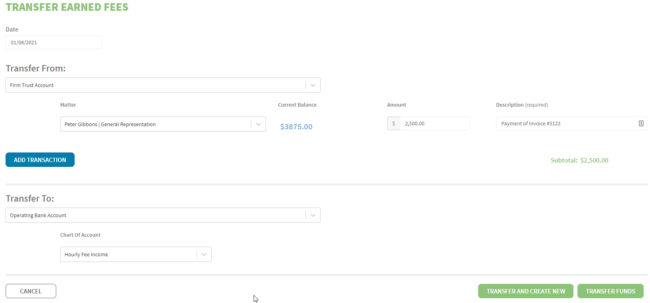

By offering both trust and operating accounting, TrustBooks makes it easy to transfer earned fees from a trust account to an operating account. The user need just select the matter, the accounts from which and into which to make the transfer, provide a description, and click to add the transfer.

While TrustBooks enables a firm to process payments both from trust and operating accounts, it retains the feature that I described in my prior review which prohibits payments from a trust account in an amount greater than the client’s available funds. If you attempt this, the system blocks the payment and warns, “You cannot make a payment in excess of current balance.”

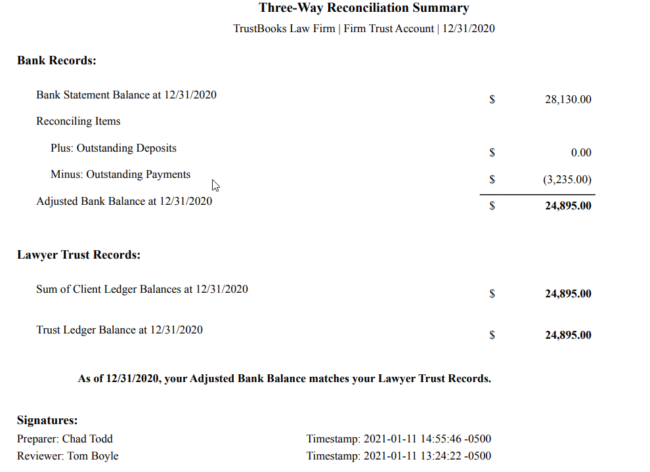

A key feature of TrustBooks is its ability to automatically perform three-way reconciliations of trust accounts, a requirement of state bar trust-accounting rules.

In addition to reconciliation reports, TrustBooks has a selection of other reporting features. In what Boyle describes as an “easy button” for reporting, it automatically generates month-end reports for payments, deposits, client activity and ledgers. Users can also create custom reports that can be filtered according to a number of parameters.

New Tiered Pricing

With the introduction of operating accounting in addition to trust accounting, TrustBooks now offers three tiers of pricing:

- $49 a month per user for trust accounting only.

- $69 a month for both firm and trust accounting.

- $149 a month for both firm and trust accounting, plus hands-on reconciliation services in which a TrustBooks CPA oversees your reconciliations, completing them each month and fixing any issues that may arise.

It also offers a 14-day free trial and free scheduled demonstrations.

Boyle told me yesterday that the biggest challenge in rolling out firm accounting was to build in the complexity it requires while maintaining the simplicity of the original product.

Based on what I saw during the demonstration, it looks like mission accomplished.

[Disclosure: TrustBooks is a paid advertiser on this blog and on my LawNext podcast.]