A common pain point for law firms is failing to track and invoice all reimbursable client expenses, resulting in losses to firm profits. A first-of-its-kind product being unveiled today by AffiniPay, the parent company of LawPay and MyCase, aims to solve that problem for smaller firms by marrying a business credit card for law firms to software that directly channels client-related expenses into the associated matters and invoices within the MyCase law practice management platform.

In addition to tracking client spending, the new MyCase Smart Spend benefits firms by giving them real-time management of and insights into their firm-wide spending, while also providing a safeguard against employee fraud resulting from shared credit cards, the company says.

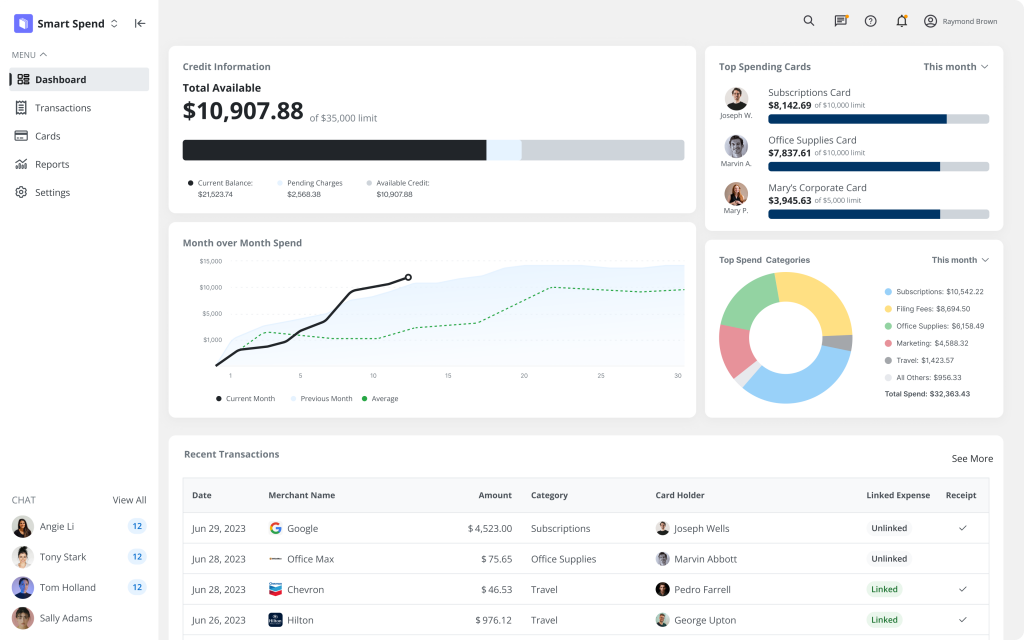

Launching initially for MyCase, and later in other AffiniPay products, MyCase Smart Spend provides law firms with a LawPay-branded Visa credit card for their attorneys and staff. All spending on the card is tracked to a dashboard where the firm can monitor all of its business and client expenses. Spending is also integrated within MyCase, so client expenses are directly tracked to the matter, including the nature and category of the expense and any associated receipts.

Learn more about MyCase in the LawNext Legal Technology Directory.

The release reflects another step by AffiniPay towards its goal of tightly integrating fintech and legaltech for law firms, so firms can, as CEO Dru Armstrong puts it, view all their financial and practice information through a “single pane of glass.” AffiniPay acquired MyCase in 2022, along with the practice management products CASEPeer for personal injury firms, Docketwise for immigration practices, and Woodpecker for document automation.

“This is our latest investment in embedded fintech that has a real impact on the financial well-being of our customers,” Armstrong said this week. “Lawyers lose money every year on reimbursable case costs. This new offering will save firms time and improve their bottom line.”

During a briefing and demonstration earlier this week, Armstrong said that MyCase customers have an average of $5,000 a month in reimbursable expenses and live in “significant fear” that they will not get reimbursed for them all. “Every dollar that they don’t get back is a dollar of lost profit to the firm,” she said.

(For more on Armstrong’s thoughts on the marriage of fintech and legaltech, see my recent LawNext interview with her: On LawNext: AffiniPay CEO Dru Armstrong on the Intersection of Fintech, Legal Tech and AI.)

MyCase Smart Spend will be released in beta in the second quarter of this year and then to general release in the third quarter. All MyCase customers will be eligible for the product, regardless of subscription tier, subject to their credit approval.

For CASEpeer customers, Smart Spend will be available in the fourth quarter of this year. A LawPay version of Smart Spend will be released early next year.

In launching this product, MyCase is partnering with the credit card company Visa and with the card-issuing platform Marqeta. Through the Marqeta partnership, Armstrong said, MyCase customers get access to real-time card issuing and transaction data and spend controls.

How It Works

During the briefing, Curtis VanderGriendt, principal product manager at AffiniPay, demonstrated how the product will work.

For law firm employees who are issued the new credit cards, the experience starts on their mobile devices, so they can quickly record purchase details immediately after a transaction.

When a firm employee makes a purchase using the card, the employee immediately receives a text message or email showing the transaction amount and merchant and providing a link to a web interface to add expense details. By following the link, the employee can add a description, such as “filing fee for John Smith auto accident,” and assign it to an accounting category from a drop-down list, such as “filing fees.” Using their phone, the employee can also upload a picture or PDF of the receipt.

While adding details, a toggle button on the screen lets the employee choose to link the expense to MyCase. If that is toggled on, the employee then gets the option to associate the expense with a specific client and matter. It will then show up in the matter in MyCase and automatically be added to the client’s next invoice.

From their phone, employees also can get full access to their account information, including how much they have spent, their available credit, recent transactions, and card details. Card holders can also access all of this through a web interface on their desktop computers.

The firm manages all of this through a Smart Spend dashboard. The dashboard lets firms’ partners or administrators monitor all spending as well as spending by employee or category in real time. It also shows which expenses are linked to MyCase.

From the dashboard, firms can decide which employees get cards and whether to issue them physical or virtual cards. Firms can set spending limits for employees and restrict their use of the card to specific categories. The firm can see an overview of all cards issued across the firms, including which are active, paused or expired. A firm could even issue multiple cards to the same employee for different purposes.

The dashboard is a separate web experience from the actual MyCase platform, but accessible through users’ same MyCase credentials. A toggle switch will allow users to go from MyCase to Smart Spend and back again.

“This is the first time that we’ve really brought together the power of LawPay’s financial services with the power of MyCase and its practice management capabilities to address the expense side or the accounts payable side of the law practice,” Armstrong said.

While there is modern line of corporate credit cards such as Brex and Ramp that have innovative features, she said, “they don’t solve this very specific problem around making sure these firms’ and these attorneys’ expenses get all the way to their invoice, and that those invoices get all the way to the end clients, and that the clients then they have a digital way to pay it.

“For us, this feels really exciting, because it’s very much closing that loop.”