Gentle readers— in a distant era (January) when no one was thinking about facemasks and hand sanitizer, I posted the  annual Dewey B Strategic Hits and Misses Survey. In an attempt to “carry on” as if everything were normal, today I am reporting on the survey results.Thanks to the 87 readers who responded to the survey between January and March 15th. Compared to 2018, 2019 was a fairly slow year for the launch of new products and features. As a result this years survey has fewer questions and fewer categories of new products. But this year the survey covered new analytics tools, analytics documentation, workflow tools, law comparison tools. The survey also asked about Westlaw Edge Adoption. Part 2 of the survey summary will report on cancellations and new products for 2020.

annual Dewey B Strategic Hits and Misses Survey. In an attempt to “carry on” as if everything were normal, today I am reporting on the survey results.Thanks to the 87 readers who responded to the survey between January and March 15th. Compared to 2018, 2019 was a fairly slow year for the launch of new products and features. As a result this years survey has fewer questions and fewer categories of new products. But this year the survey covered new analytics tools, analytics documentation, workflow tools, law comparison tools. The survey also asked about Westlaw Edge Adoption. Part 2 of the survey summary will report on cancellations and new products for 2020.

Best New Analytics Product LexisNexis Context Court Analytics was voted best new Analytics product. Thomson Reuters Westlaw Edge Analytics and Gavelytics tied for second place.

Best Analytics Documentation: Lex Machina For the second year in a row, Lex Machina was voted as having the best analytics documentation. Why this matters… no one should use an analytics product unless they understand what is ‘under the hood”. All analytics products are not created equal.. and neither is their documentation. Thomson Reuters, Bloomberg Law and Docket Navigator all shared the 2 place slot.Demands from the librarian marketplace appear to be having an impact. Ironically Lexis Context which was voted the best product – also had the worst documentation getting only 3.75% of the votes.

Best New Drafting/Workflow Product: Thomson Reuters brief analyser tool Quickcheck came out on top. Bloomberg Law took the second and third place slots with their Practical Guidance for Litigators and their Transactional Intelligence Center respectively.

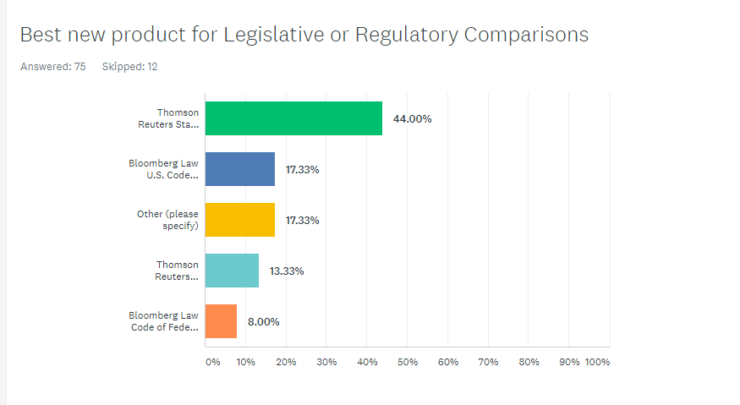

Best New Statutory/Regulatory Tool: Thomson Reuters State Regulations Compare This product took 44% of the vote. Bloomberg Law’s US Code Version Redlining came in second with 17% of the votes.

Westlaw Edge Adoption Only 36% of the respondents are at firms that have purchased Westlaw Edge. Cost was the overwhelming reason noted for non-adoption was cost.