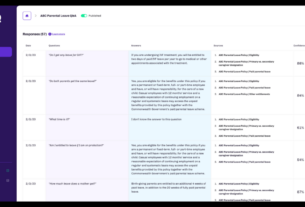

Tax lawyers want it all. And the more granular and up-to date the better. Today Wolters Kluwer Legal and Regulatory released a new alerts  feature in digital Tax Reporters Plus Suite on Cheetah that will enable tax lawyers to track alerts for changes in the tax code, regulations, explanations and other code related documents.

feature in digital Tax Reporters Plus Suite on Cheetah that will enable tax lawyers to track alerts for changes in the tax code, regulations, explanations and other code related documents.

Alerts in a Time of COVID

New legislation is always followed by a raft of regulations and administrative materials.Since the passage of the CARES Act PL 116-123 and the Families First Act PL 116-127 in response to the COVID pandemic tax lawyers have been on high alert monitoring the implementing regulations and interpretive materials.

With the Tax Reporters Plus Suite’s new Alerts feature, users can set alerts to monitor tax code sections they are interested in and receive. email alerts whenever the section changes. Users will be alerted for both statutory and regulatory changes and can track legislation at both the federal and state levels. They can also redline changes from within the alert.

“In light of new federal and state legislation that has been passed in response to the COVID-19 pandemic, tax attorneys and the businesses they serve are entering uncharted waters this year,” said Ken Crutchfield, Vice President and General Manager of Legal Markets at Wolters Kluwer Legal & Regulatory U.S. “It’s still unclear how major events for a company, like PPP debt forgiveness, M&A or bankruptcy, might be impacted by new provisions, and monitoring for tax code changes has taken on new importance as a result of how quickly the landscape is changing. With the addition of the Alerts feature, our acclaimed Plus Suite will deliver higher value by significantly improving users’ speed and accuracy when researching changes to tax codes, saving them hours of manual work. This tool is the result of direct feedback from our customers, and we are very pleased to bring this impactful feature to the market.”

Cheetah for Tax Law, the Tax Reporters Plus Suit

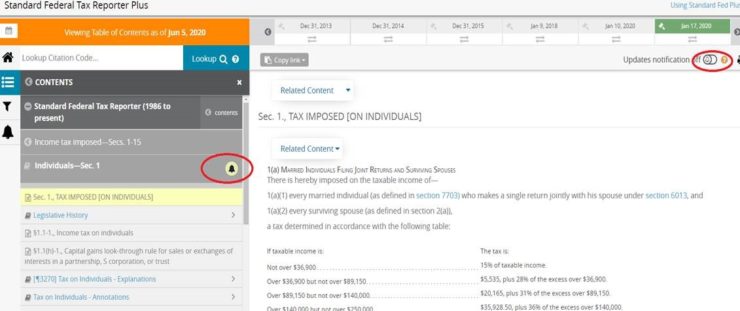

The Suite includes Standard Fed Plus, State Tax Plus, and Estate & Gift Tax Plus and includes an issue archive of Standard Federal Tax Reporter dating back to 1986, the State Tax Reporter and the Estate & Gift Tax Reporter, as well an Internal Revenue Code archive dating back to 1954.

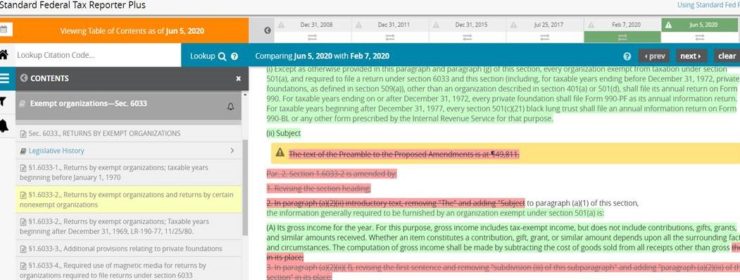

Tax lawyers can easily identify legislative and regulatory changes to support proper interpretation of a rule through its new features including:

- Legislative Change Dashboard

- Point-in-time and redlining functionality expanded

- Expertise and guidance

To learn more about the Alerts feature, visit: https://lrus.wolterskluwer.com/store/standard-fed-plus/

To learn more about Tax Reporters Plus Suite, visit: https://lrus.wolterskluwer.com/store/tax-reporters-plus-suite/