As awful as was the year 2020 for so many reasons, my year-end report last year found reasons to be optimistic. “The silver lining of 2020,” I wrote, “is that we have been forced to consider changes that were long overdue and then given the opportunity to implement those changes.”

This year, my report is tainted by a degree of pessimism. As I survey the legal profession broadly, and the world of legal tech and innovation specifically, I see uncertainty and inertia.

It is as if we are serving time in a legal tech limbo.

Whereas 2020 ended with a newfound sense of the possible, 2021 ends with us still not knowing what is ahead, and therefore which way to turn.

Whereas 2020 ended with great promise for regulatory reform, 2021 ends with little further progress on that front – and even retreats to some extent.

Whereas 2020 ended with hope for a return to some sense of normalcy – even if it was to be the much-vaunted “new normal” – 2021 ends with us still wondering about what the future holds and how to plan for it.

I should be more optimistic. After all, it was a good year for the legal tech industry. Many companies thrived thanks to the pandemic-induced accelerated adoption of tech. Lots of investment money flowed into companies, with the promise of fueling even better products and services. Overall, the legal tech industry saw unprecedented growth.

But the end game in all this is not tech for tech’s sake – and therefore not growth for growth’s sake. The end game is to better serve our clients and those who need our help and services. During 2020, we were forced to make significant strides towards that goal through better use of technology. But in 2021, progress felt slower, as if we were mired in malaise.

Coming off the accelerated innovation of 2020, 2021 seemed to leave us wondering how best to build on those changes over the long haul.

Against that backdrop, here are my picks for the top legal tech trends of 2021.

(Here are my prior years’ lists of the most important developments: 2020, 2018, 2016, 2015, 2014, 2013. For 2019, I replaced the year-end list with a decade-end list. In 2017, I bypassed the list to focus on a single overarching development, The Year of Women in Legal Tech.)

1. The new normal became the endless uncertainty.

For all that was horrible about 2020, we emerged from it and crossed over into 2021 with a sense of hope. In the realms of legal technology and innovation, the pandemic had yielded silver linings – greater adoption of technology, more flexible workplaces, hybrid courts – that promised a future in which the legal profession and justice system would better serve those who need them.

But as the pandemic persisted and new variants emerged, some of that hope dissipated and some of those silver linings became tarnished. Where legal innovation in 2020 was characterized by acceleration and adaptation, in 2021 it was slowed by a sense of malaise – malaise driven by uncertainty.

We are stuck in a perpetual state of betwixt and between, a kind of innovation limbo. Do lawyers return to the office or not? Do courts fully reopen or not? Do legal conferences return live or not?

The victim of this limbo is progress. Yes, in 2020, the legal industry accelerated its adoption of technology. But in 2021, we are still figuring out how best to deploy it, stymied by the lack of a clear vision of the future.

If a law firm is unable even to decide whether its staff should return to the office, or when that return should happen, or how to structure that return, then how can that firm implement lasting and innovative changes in its technology infrastructure and systems?

This is not to say that 2021 was without innovation. Stories are replete of law firms and courts and other legal services entities developing innovative methods and solutions to better perform their work and serve their clients, and legal tech developers introduced many innovative new products.

But in a year in which we have been unsure which way to turn, it is difficult to plot a course towards the future.

2. Regulatory dominoes remained standing.

2. Regulatory dominoes remained standing.

In my year-end trends report 12 months ago, I characterized 2020 as the year regulatory reform got real. That was a year marked by two historic advances – the August vote by the Utah Supreme Court approving sweeping changes in legal services regulation in that state, followed two weeks later by the Arizona Supreme Court going even farther, becoming the first state in the nation to completely eliminate the ban on nonlawyers having economic interests in law firms and the prohibition on lawyers sharing legal fees with nonlawyers. Also last year, the Minnesota Supreme Court approved a pilot project to permit “legal paraprofessionals” to provide legal services in certain matters.

As I wrote then:

“In a perfect-storm-style confluence of events, 2020 brought major advances in regulatory reform – advances that came about independent of the pandemic, but that could not have been better timed, as the pandemic exposed the fundamental weaknesses in the delivery of legal services and the administration of justice and the dire need for reform.”

Earlier this year, for an episode of my LawNext podcast, I interviewed Arizona Supreme Court Vice Chief Justice Ann A. Scott Timmer, who was not only among the justices who approved the changes in that state, but who also chaired the task force that recommended them. I asked her if Utah and Arizona were the first dominoes that would set off a chain reaction of other states following suit.

Her answer was optimistic. She predicted that other states would follow suit, not necessarily because of what Arizona had done, but because chief justices and regulators in other states were already thinking about implementing reforms in order to address the growing gap in access to justice. The wheels were already in motion, she was effectively saying.

Yet, for all that happened in 2020, regulatory reform has gained little ground in 2021. The only significant development came in September 2021, when the California Paraprofessional Program Working Group submitted its final report and recommendations that offered broad proposals for the creation of a paraprofessional licensing and certification program aimed at increasing access to legal services.

But earlier this month, regulatory reform in California suffered a setback when the chairs of two legislative judiciary committees in the state accused the state bar of “divert[ing] its attention from its core mission of protecting the public” by considering proposals to allow nonlawyers to provide limited legal services.

As reported by Cheryl Miller in The Recorder, Assemblyman Mark Stone, D-Scotts Valley, and Sen. Tom Umberg, D-Santa Ana, wrote a letter to bar leaders on Dec. 7 warning that “any proposal that would materially change current consumer protections for clients receiving legal services and fundamentally alter the sacrosanct principles of the attorney-client relationship would be heavily scrutinized by our committees.”

This is not to say there has been no progress. In Florida, a committee appointed by the state Supreme Court approved “in concept” changes that would create a Law Practice Innovation Laboratory Program similar to Utah’s regulatory sandbox and that would allow some loosening of the rules around nonlawyer ownership of law firms. But whether or when these changes will be made in Florida remains to be seen.

Elsewhere, Oregon moved slightly forward on a plan I first reported on two years ago to create a paraprofessional licensing program in that state. This year, it opened the proposal to public comment, with the expectation that the state’s supreme court will vote on it sometime in 2022.

And it is true that other states continue to look at various reform measures along these same lines, including Colorado, North Carolina and Illinois.

But as we close out of 2021, the regulatory dominoes largely still stand. Whereas 2020 brought dramatic strides, 2021 has seen little further progress. Do I believe these dominoes will fall? I do. In fact, I think it is inevitable that, sooner or later, virtually every state will adopt substantive reforms. But at this pace, it may be later rather than sooner.

3. Legal tech went public.

3. Legal tech went public.

Before 2021, the last time a legal technology company went public in the U.S. was nearly two decades earlier, in 2002, when the document management company iManage debuted on the Nasdaq market.

In the years since, the legal tech market saw little IPO activity. In 2019, KLDiscovery became a public company as the result of a merger. In 2015, AppFolio, which then owned practice management platform MyCase, went through an IPO, but its primary products were not in legal, but in property management.

In February 2019, the ALSP Axiom said that it was preparing for an IPO, but later abandoned that plan and instead entered into an agreement with private equity firm Permira under which a company backed by Permira would take a significant investment in Axiom.

(In Australia, legal tech company Nuix went public in 2020 – an IPO that has been haunted by regulatory investigations and class-action lawsuits over claims that the company misrepresented its financial information.)

Given this paucity of U.S. legal tech IPOs, it is notable that 2021 saw three U.S. legal tech companies go public: alternative legal services provider LegalZoom (Nasdaq:LZ), legal technology company Intapp (Nasdaq:INTA), and e-discovery company DISCO (NYSE:LAW).

In Gloucester, Mass., where my office is located, people speak often of the Perfect Storm of 1991. It was that rare alignment of meteorological events that led to the tragic loss of the Gloucester-based fishing boat Andrea Gail, an event memorialized in Sebastian Junger’s book The Perfect Storm and the film adaptation starring George Clooney.

So I wondered: Was this confluence of IPOs the legal tech equivalent of a perfect storm? On a recent episode of my LawNext podcast, I put that question to Kiwi Camara, founder and CEO of DISCO, one of the companies that went public. He said that what we saw this year was just the beginning of a perfect storm.

“What you’ve seen over the last eight years is investors have become more and more confident that the same kind of transformation will come to the legal function as has happened to all the other big corporate functions,” Camara said. “You can think of things like sales and finance. Just as software has been built to help automate and accelerate the work of those functions, software’s coming to the legal function. … Investors are placing big bets that big software companies will be built in this space.”

As for that iManage IPO 19 years ago, it did not remain public for long. In 2003, iManage was acquired by Interwoven for $171 million. In 2009, Autonomy acquired Interwoven for $775 million, and then in 2011 Hewlett Packard purchased Autonomy for $11.1 billion, getting iManage in the deal.

The Autonomy acquisition turned into a fiasco for HP due to alleged accounting improprieties by Autonomy, resulting in both litigation and a write-down of nearly $8.8 billion of the purchase price.

Amid that turmoil, the iManage leadership was able to buy out the company and its business from HP. Original cofounders Neil Araujo and Rafiq Mohammadi returned to top leadership roles as CEO and chief scientist, respectively, and set to work on reinvigorating the core on-premises product and relaunching its cloud product, which it did in 2016 as iManage Cloud.

Today, iManage is privately owned and doing quite well, thank you. Over the course of the pandemic, CEO Araugo told me in a recent interview, its revenue has grown 70% and the business has grown 200% over the past year.

4. Legal tech conferences contorted.

4. Legal tech conferences contorted.

Pity the poor conference organizer. If, as I asserted above, the entire legal industry is betwixt and between, then the conference organizer is impaled on the horns of a dilemma. Do I plan for a virtual event or a live event or some hybrid of the two? If I remain virtual, the exhibitors who support us may not show up. But if I go live, the attendees may stay home. I could do hybrid, which kind of caters to both sets of conflicting interests, but I would only partially satisfy either.

The case study for conference confusion in 2021 was ILTACON, the annual conference of the International Legal Technology Association.

When ILTA announced in February that that it would return to in-person programming for its August conference (while keeping a virtual component), my reaction was to applaud it for its courage. At that point, even though we were still emerging from the pandemic, it felt certain that we were, in fact, emerging. ILTA’s move felt like a giant step forward towards normalcy.

But as the date neared, COVID’s Delta variant surged, raising fears and concerns among some who had planned to attend. Just a week before the start date, iManage, a major exhibitor, informed its customers that it was pulling out of attending the conference in person. Soon, another major vendor, Litera, also pulled out.

And although I had planned to be there in person, I ultimately joined the ranks of those who stayed home. My blog post explaining my reasons for pulling out was my most-read post of 2021, which suggests that many others were themselves debating whether to attend.

Was ILTA wrong to meet in person? Not in the least. I have heard good reports from those who attended. I still believe it was an act of courage for ILTA to schedule the live event, and based on what we knew as of February, it seemed like the right move.

But it illustrates the conundrum conference organizers face. And rather than fully confront it head on, they have contorted the classic concept of a conference to try to make it fit the virtual or hybrid model. I am not sure anyone has yet figured out how to do that to the satisfaction of everyone.

As we enter the new year, two major legal tech conferences are on the immediate horizon, Legalweek in New York, Jan. 31 to Feb. 3, and ABA TECHSHOW in Chicago, March 2-5. Both plan to hold in-person conferences (including a in-person version of the Startup Alley I organize for TECHSHOW). But with yet another surge of yet another variant, a giant question mark looms over both events.

As I said: Pity the poor conference organizer.

5. Courts adapted, but not to the benefit of all.

5. Courts adapted, but not to the benefit of all.

Legal futurist Richard Susskind has long been admired for his prescience, but he seemed to have outdone himself when, in December 2019, three months before the coronavirus forced the shutdown of courts throughout the world, he published his book, Online Courts and the Future of Justice. In that book, he wrote that the process of modernizing courts must be gradual, because “you can’t change the wheel on a moving car.”

But, as I wrote in last year’s year-end report, “Then came the pandemic, blowing out all four tires and seizing the transmission.”

Remarkably, courts adapted. In fact, a recently published study by The Pew Charitable Trusts concluded that courts not only met the pandemic challenge, but responded to it quite effectively by embracing technology and revolutionizing their operations.

Beginning in March 2020, Pew found, courts adopted technology at unprecedented speed and scale, initiating online hearings and moving other routine functions online, such as electronic filing.

The report offered the example of the Texas court system, which had never held a civil hearing by video before the pandemic, but which conducted 1.1 million remote proceedings (civil and criminal) from March 2020 to February 2021.

But the benefits of this court modernization were not evenly distributed. Pew also found that courts’ adoption of technology had a disproportionate impact, benefitting individuals and businesses with legal representation, while posing disadvantages for those without legal representation.

For example, the report said that just after courts closed down, national debt collectors quickly ramped up filings, using online tools to file thousands of lawsuits every month.

Meanwhile, many pro se litigants faced hurdles due to their lack of high-speed internet service or computers or because of disabilities or limited English proficiency. Others were blocked out of courts by archaic rules that prevented individuals without lawyers from filing documents electronically.

The bottom line, according to Qudsiya Naqui, officer, Civil Legal System Modernization, at Pew, and one of the authors of the report is that courts’ advances in technology show promise. “However, if courts fail to improve existing processes, they run the risk of digitizing their problems rather than solving them.”

Related: On LawNext: How Courts Met the Pandemic Challenge, with Qudsiya Naqui of The Pew Charitable Trusts.

That means that, for courts to continue to build on the advances they have implemented during the pandemic, they need to focus on process improvements, rather than just layer technology on top of archaic and complex court processes. And that means testing new tools with users and collecting and analyzing feedback to help guide technology decisions.

Courts have finally been able to change the tires. Now they need to work on remapping where they’re headed.

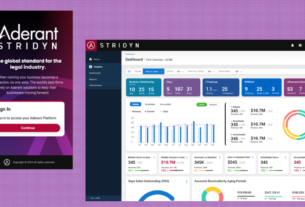

6. Consolidation continued in practice management.

6. Consolidation continued in practice management.

Three-quarters of the way through 2020, in my column at Above the Law, I wrote about a trend that emerged that year of acquisitions and consolidations of law practice management companies. This year saw that trend accelerate even more.

To understand this trend, it helps to go back to the last quarter of 2020, and specifically to Sept. 8, when news broke that the practice management platform MyCase had been sold by its owner, AppFolio, to the private equity firm Apax Partners for a whopping $193 million in cash.

Soon after that, on Sept. 22, the news came that ASG LegalTech, the company that owned cloud practice management platforms PracticePanther, Bill4Time, and MerusCase, had acquired the online payments platform Headnote.

Just two days later, on Sept. 24, it was revealed that the practice management company Rocket Matter had been acquired by the private equity firm Lightyear Capital LLC, making it part of a new company, ProfitSolv, that also included two other recently acquired companies, TimeSolv, a provider of cloud-based legal billing and timekeeping software, and ImagineTime, a practice management and payments company serving accounting and other professional services firms.

The final 2020 investment came Oct. 6, when Actionstep, a cloud-based practice management system founded in New Zealand and with a significant presence in the U.S., received an investment from Serent Capital, a San Francisco private equity firm focused on investing in high-growth technology and services businesses.

If all that consolidation was not dizzying enough, 2021 brought even more.

In fact, as the year dawned, it took just a week for there to be more practice management news, as the aforementioned ASG LegalTech, rebranded itself as Paradigm, a move the company said better represented how it viewed itself, its customers and its plans for moving forward.

From there, the news of consolidations, acquisitions and investments in practice management just kept rolling in:

- March 11: AbacusNext, a provider of legal, accounting and compliance software – and which also owns AbacusLaw, Amicus Attorney, Amicus Cloud, and the document automation software HotDocs – is acquired by private equity firm Thomas H. Lee Partners.

- April 27: Clio becomes the first practice management company to achieve unicorn status with a Series E investment of $110 million at a valuation of $1.6 billion.

- June 2: The cloud practice management company SurePoint Technologiesannounces a strategic investment from the private investment firm Aquiline Capital Partners by which Aquiline acquires majority ownership.

- July 2: Four months after its acquisition, AbacusNextsays it has combined with Zola Suite, a SaaS legal practice management software provider, to create what they call “the strongest portfolio of legal software solutions on the market.”

- July 6: This blog breaks the news that MyCase had quietly acquired two legal technology companies in the preceding months: CASEpeer, the case management platform for plaintiffs’ attorneys, and Woodpecker, which provides legal document automation software for solo and small law firms.

- July 9: This blog reports on yet another stealth practice management acquisition, this time of Tabs3 Software, one of the oldest practice management products in the legal market, having been founded in 1979, and which also owned the cloud-based practice management platform CosmoLex. The new owner is ProfitSolv, the company that helped kick off this spate of consolidations in 2020 with the acquisitions of Rocket Matter and TimeSolv.

- July 28: Clio acquires the automated court-calendaring company CalendarRules. It is Clio’s first acquisition since becoming a unicorn three months earlier and only its second acquisition ever.

- 23: Centerbase, a Dallas company providing legal practice management software for mid-sized law firms, receives a growth equity investment from Mainsail Partners, a firm that invests exclusively in fast-growing, bootstrapped software companies.

- 8: Making its second acquisition in six weeks, Clio acquires Lawyaw, a document automation and assembly platform designed for solo, small and mid-sized law firms.

- 30: Law practice management company Smokeballsecures a $30 million investment from private investors and employee shareholders in order to double down on growth.

- 13: Paradigm, the company that started the year with its rebranding from its former name of ASG LegalTech, is acquired by Francisco Partners, a major investment firm that specializes in investments in technology businesses.

- 9: Following its acquisitions earlier in the year of CASEpeer and Woodpecker, MyCase announces that it has acquired the cloud-based legal accounting company Soluno, and that it will leverage Soluno’s expertise to develop full-featured accounting natively within its platform.

In that 2020 Above the Law column I mentioned above, I speculated that the spate of acquisitions was driven, at least in part, by the pandemic. I stand by that. As I explained then, the pandemic made cloud practice management into a very good business to be in, creating an appealing investment opportunity for private equity firms.

Also driving this, I believe, is the e-payments factor. The pandemic accelerated the need for lawyers to accept e-payments, and for all the acquisitions I described in that 2020 post, e-payments was a significant part of the companies’ technology. While the ASG LegalTech acquisition of Headnote was the most explicit example of that, both MyCase and Rocket Matter already had their own e-payments technology before their acquisitions.

This year, we saw companies realize the fruits of those acquisitions and consolidations by launching native e-payments in several of their platforms, such as Bill4Time did in May and Tabs3 and CosmoLex did in July.

Capping that trend was Clio’s announcement in October of its launch of its own native e-payments technology, Clio Payments, which CEO Jack Newton characterized as the company’s most important product release since its launch.

7. The profession’s protectionist paranoia persisted.

7. The profession’s protectionist paranoia persisted.

For all the apparent gains the legal profession made in accelerating its adoption of technology during 2020, the year 2021 offered ample evidence that many lawyers continue to fear technology and innovation and see them as threats to their protectionist guild.

Back in 2018, I wrote about the obstacles to innovation in law, including among them lawyers’ fear of technology and the fact that the legal profession remained “a protectionist guild that sees innovation as a threat.” In a companion piece, I offered suggestions for how to “reboot” the justice system to promote innovation.

I thought we’d moved past that. Given the extent to which the pandemic left lawyers no choice but to adopt, learn and deploy technology, I would have thought that many of their fears would have been alleviated. Bias, after all, is the byproduct of ignorance. If lawyers overcame their ignorance of tech, I would have thought, so too would they have overcome their bias towards it.

Apparently, I was wrong.

As Exhibit A, I offer you that California legislators’ letter I referenced in part two above on regulatory reform. As I noted, in response to the State Bar of California’s study of ways to close the justice gap, the chairs of the judiciary committees of the state’s assembly and senate, Assemblyman Mark Stone and Sen. Tom Umberg, wrote a letter to bar leaders criticizing them for diverting resources to that study.

Their letter warned that “any proposal that would materially change current consumer protections for clients receiving legal services and fundamentally alter the sacrosanct principles of the attorney-client relationship would be heavily scrutinized by our committees.”

They went on to assert the unproven and ignorant argument that has been the mainstay of the legal profession’s guild protectionists:

“Corporate ownership of law firms and splitting legal fees with non-lawyers has been banned by common law and statute due to grave concerns that it could undermine consumer protection by creating conflicts of interests that are difficult to overcome and fundamentally infringe on the basic and paramount obligations of attorneys to their clients.”

As Exhibit B, I give you the Florida Supreme Court’s Oct. 14 decision in The Florida Bar v. TIKD Services LLC – a case in which the court concluded that an app to help consumers fight parking tickets was engaged in the unauthorized practice of law.

To be fair, the court’s ruling was not actually that an app was practicing law, but that the company behind the app was practicing law by the manner in which it reviewed incoming cases and referred them to lawyers.

But the opinion is replete with the same sort of protectionist language that has been used for decades to block those who are not licensed attorneys from delivering legal services. It focuses on the Rules of Professional Conduct, and suggests that there is no parallel way to regulate alternative legal services providers – a suggestion already disproven in both Arizona and Utah.

The court says:

“TIKD simply lacks the skill or training to ensure the quality of the legal services provided to the public through the licensed attorneys it contracts with, nor does it possess the ability to ensure compliance with the Rules of Professional Conduct.”

It goes on:

“We will certainly not jettison these ideals by sanctioning the unregulated commoditization of legal services — a paradigm shift that would put corporations governed solely by the profit motive between lawyers and their clients.”

Thus, as we prepare to cross over into the year 2022, we still have leading legislators in California and leading jurists in Florida espousing the same anachronistic views that have for decades blocked progress in innovating legal services and closing the justice gap.

Regrettably, I rest my case.

8. Remote work exposed inequalities.

8. Remote work exposed inequalities.

As working remotely has continued to remain the norm, many legal professionals have embraced it wholeheartedly, vowing (or lobbying) never to return to the office. But as the initial novelty of remote working has worn off, it has become clearer that it was more of a hardship for some in the legal world than for others.

I have already talked above about the Pew study of how courts adapted to the pandemic, and of how courts’ accelerated adoption of technology disproportionately benefitted individuals and businesses with legal representation, while posing disadvantages for those without legal representation.

But it was not just self-represented litigants who were disadvantaged by remote work. The ABA’s 2021 Profile of the Legal Profession Report looked at how the pandemic affected lawyers – and found that it hit some harder than it did others.

Most notably, women lawyers and lawyers of color were more likely than other lawyers to have difficulty maintaining separation between their home and work lives. And both women and lawyers of color were much more likely to find their work disrupted and to feel overwhelmed and stressed.

Another group hit hard by the pandemic was older lawyers, the ABA report found. More than a third of older lawyers saw their income drop during the pandemic, and a third said the pandemic caused them to change their retirement plans (with some postponing retirement and others hastening it).

There is also evidence that working from home was harder for smaller-firm lawyers than for their larger-firm counterparts. In February, Clio released the Legal Trends for Solo Law Firms report, finding that solos struggled more significantly than larger law firms in adapting to remote work throughout the pandemic, suffering greater shortfalls in new cases and firm revenue.

James Cotterman, a law firm consultant with Altman Weil, told the ABA Journal’s Lyle Moran that he has seen small firms struggle more than their larger counterparts. “The pivot to remote work was more challenging with less robust tech support and clients less likely to engage or pay timely,” he said.

9. Diversity proved elusive.

9. Diversity proved elusive.

One of the greatest challenges facing the legal profession remains one of the most elusive to overcome – that of its lack of diversity.

In my year-end report for 2020, I wrote:

“[M]y sense is that the legal profession as a whole, and the legal tech industry specifically, made little progress in 2020 towards enhancing diversity, and may even have taken a few steps backwards. As a profession and as individuals, I believe, we must make equality our top priority going forward.”

A year later, and there is little evidence of progress. In fact, an analysis published by Law360 Pulse in August found that, from 2019 to 2020, diversity numbers at U.S. law firms barely crept up, with minorities representing just over 18% of attorneys and 10% of partners, virtually the same as the prior year.

More strikingly, in the seven years since 2014, the percentage of minority attorneys in law firms rose just four points, from 14.1% to 18.1%. The numbers of partners and equity partners rose even less, from 8% to 10.8% of all partners and from 7.1% to 9.7% of equity partners.

The legal tech industry is no better. In 2018, Paladin cofounder Kristen Sonday studied legal tech companies and their founders and determined that women and people of color were significantly underrepresented among founders, accounting for just 13.6 percent and 26.5 percent respectively.

Black and Latinx founders accounted for a staggeringly low proportion of legal tech entrepreneurs, she found, at just 2.3 percent and 3.1 percent respectively.

Earlier this year, Sonday repeated her study and found that the number of founders of U.S. legal technology companies who are women or people of color had dropped since 2018. While the number of women founders dropped from 66 in 2018 to 57 in 2021, the number of Black and Latinx founders had edged up slightly, from 11 Black founders in 2018 to 13 in 2021 and 15 Latinx founders in 2018 to 17 in 2021.

Overall, the number of diverse founders in legal tech dropped from 478 in 2018 to 392 in 2021.

At the risk of being a broken record, I will repeat what I wrote last year: The greater the diversity in legal tech, the more we all stand to benefit, whether we are developers of products or purchasers, whether we are those who deliver legal services or those who receive them. And we can all play a role in helping to make greater diversity a reality.

10. Hybrid is here to stay.

10. Hybrid is here to stay.

I opened this post with a discussion of the endless state of uncertainty in which we find ourselves. One thing, however, does appear certain: Hybrid is here to stay.

The contours of a hybrid legal industry are still being shaped. But it is, at this point, beyond doubt that the law office of tomorrow will not be the same as the law office of 2019. The same is true for the courts of tomorrow, the legal departments of tomorrow, the law schools of tomorrow, and the conferences of tomorrow.

Law offices will occupy less real estate and use what real estate they have more flexibly. Courts will put more processes online or in self-service kiosks. Legal departments will be more distributed in their staffing and efficient in their operations. Law schools will offer degrees at least partly online. Conferences will forever allow the option of attending virtually.

Studies support this. Clio’s recently released 2021 Legal Trends Report indicates that lawyers and clients alike now prefer some form of remote work.

In 2018, only 23% of consumers were open to the idea of working with a lawyer remotely, the report said. This year, 79% of consumers saw the option to work remotely with a lawyer as an important factor that would positively influence their decision to hire that lawyer.

“This isn’t to say that clients expect a fully remote legal experience. In fact, 67% said they would look for a lawyer offering both remote and in-person options when searching for an attorney. This figure increased to 79% among consumers who had hired a lawyer in the past.”

Clio’s report also found that law firms are rethinking how they design their physical office spaces and what that means for how they deliver services to their clients. The survey found that 81% of law firms are currently enabling remote working for staff and clients, and that 71% are prioritizing remote interaction over in-person.

“The potential implications of these office arrangements could have a powerful impact on not just profitability, but also the nature of the legal services that are provided to clients. Reducing spend on office space could open up revenue for better profitability and investment in other areas of the business, such as staffing or technology, further increasing a firm’s growth prospects.”

A legal industry report published by MyCase made similar findings. The report said that 53% of firms would allow lawyers and staff to work remotely fulltime upon the reopening of their offices. Seventy percent said they would allow attorneys and staff to work remotely part-time once their offices were fully reopened.

“[O]ne thing is certain: remote working is here to stay even as law firms begin to reopen. The effects of the pandemic have changed how legal professionals view the concept of ‘work’ and where they get it done. Full-time remote work won’t be the norm once the immediate effects of the pandemic recede. But working from home a few days each week? That will undoubtedly be much more commonplace for legal professionals in the years to come.”

The key takeaway from the past two years is that hybrid is actually better in most cases. For legal professionals, it offers healthier work-life balance without diminishing productivity. For clients, it offers greater convenience in working with a lawyer and greater options in choosing a lawyer. For courts, it offers tools for achieving greater efficiency and better serving the public. For litigants – particularly for those representing themselves – it offers easier access to the justice system.

Even as we continue in a state of uncertainty, one thing is absolutely clear: There is no turning back to the way things were.