The results of the Dewey B Strategic 2020-2021 Hits and Misses Survey are in. Thanks to everyone who took the time to participate in the survey.

the survey.

The demographics. The survey was conducted from February 16th through March 1st 2021. There were 101 respondents. The respondents described their professional positions as follows: 81% librarians/knowledge managers), 11% law firm management, 5% IT professionals, 3% practicing attorneys, 1% data scientists.

As usual I have asked readers to identify the best new products in several categories including news, analytics, workflow. Readers also provided the names of products they plan to cancel or acquire. I could not ignore the defining issue of 2020 – so I asked a series of questions about the performance of legal publishers in response to COVID.

What was the most significant development in legal technology/publishing?

I love and respect my readers but I don’t always agree with them. I have to admit I was truly shocked that readers selected the shuttering of Ross Intelligence the most significant development of 2020. Here’s why— frankly I only know a handful of firms that had purchased Ross. I realize that what Ross lacked in market penetration, Andrew Arruda overcame by driving a bold and persistent “robot lawyer” meme into the legal tech biosphere. Clearly the mythology of Ross Intelligence will live on long after the company is gone.

Ross ( as well as Fastcase and Casetext) were inspired by and built on the belief that there needs to be a lower cost alternative to the Lexis/Westlaw duopoly. Lexis and Westlaw as discussed below continue to push the pricing envelope and the may be closer to a market implosion than they realize.

The continued expansion of the Fastcase platform ranked second, the launch of Lexis+ ranked third and the launch of the AI enabled motion drafting tool Casetext Compose ranked 4th.

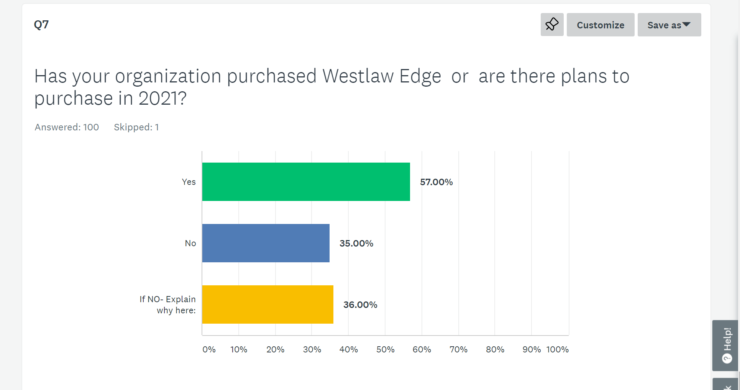

Lexis vs. Westlaw vs Law firm budgets. In the past two years, traditional rivals Lexis and Westlaw both launched new platforms which jacked up the already significant cost of the legacy platforms. Lexis+ which launched in mid-2020 had been adopted by 13% of the respondents. The Lexis + launch was covered in this post. Westlaw Edge which launched in 2019 had been adopted by 57% of the respondents. The Westlaw Edge launch was covered in this post. No one was shy about expressing their outrage at the premium upcharges associated with the new products. The vast majority of respondents are unhappy with Lexis and Westlaw pricing.

Stay tuned upcoming posts will cover COVID issues, analytics, workflow, marketplaces and the ever popular lists of products to be purchased and cancelled by respondents.