On April 1st, Intelligize users will experience a major transformation of the platform. The new features will be available to all Intelligize users at no additional cost. I reviewed Intelligize’s unique features when it launched as a startup . It was purchased by LexisNexis in 2016. Intelligize was a late entrant into the SEC research market, but managed to drive most competitors from the field. It is built on proprietary algorithms which streamline not only SEC filings research but more importantly, complex regulatory comment letter and no action letter research. The upcoming redesign will offer a whole raft of new features which drive efficiency and deliver new analytics and insights. New redlining and comparative features are woven into the comment letter, M&A and drafting modules.

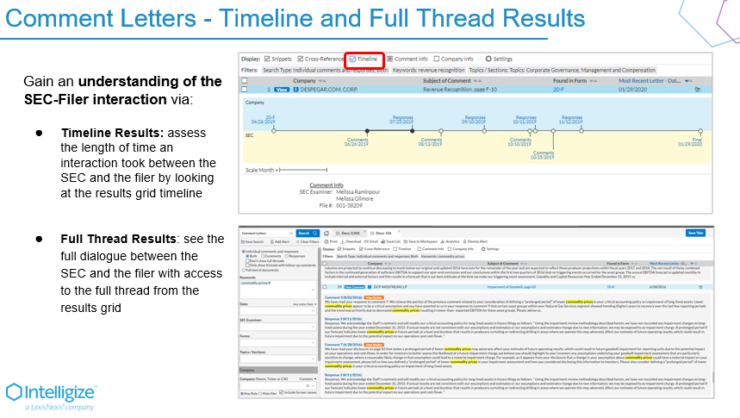

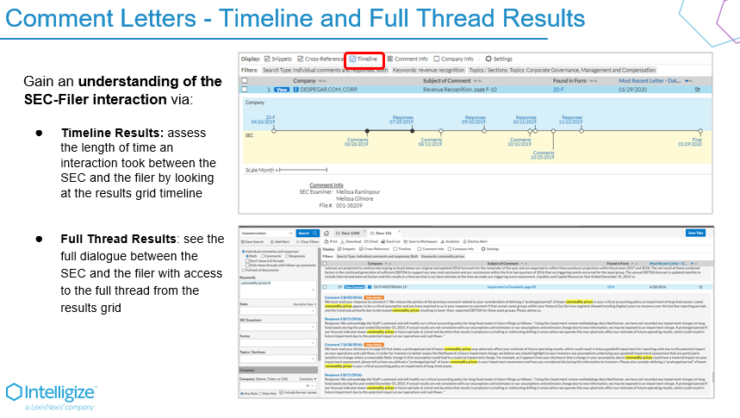

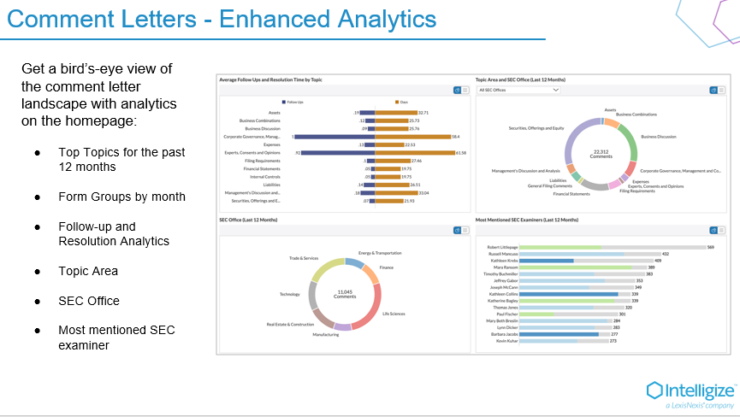

The Comment Letter enhancements are designed to help lawyers understand how to avoid SEC scrutiny. The analytics provide insights into how the SEC’s focus on various issues evolves over time. Machine learning insights help lawyers locate similar comments to the one their client has received and then generate analytics based on that issue.The timeline feature helps lawyers assess the interactions between the SEC and the filer and understand the timing to resolution. The “full thread” results enables lawyers to see the full dialogue between the SEC and the filer. When looking for similar comment letters machine learning will provide a similarity score.

The Comment Letter Analytics Provide trending topics for the last 12 months, identify which offices are involved in specific issues and identify the most mentioned SEC examiner. The analytics button allow lawyers to develop custom analytics on an issue.Timeline results assess the length of time interaction with the SEC and the filer took.

Mergers and acquisitions enhancements Lawyers have the choice of analyzing deals in a grid or a card format. Results grid view compare deal points across multiple transactions in a table format. Results t card view shows the acquirer and the target information side-by-side. Transaction timeline provides a visualization of important documents that were filed during a transaction. The Compare feature allows researchers to more easily add documents for comparison. Side-by-side red lining show changes in language.

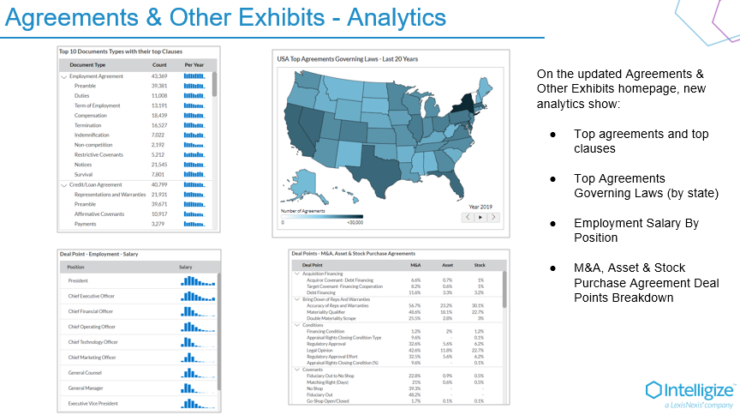

SEC filings, Agreements and Other Exhibits Features include Analytics, New compare document,,New side-by-side redlining. Analytics include. negative events disclosure, filings by month, accounting firms auditing 10 K filers, 10K filings by industry segment.

Securities and Drafting Compliance

A new 8K checklist allows lawyer to create customized checklist which include only the 8K items applicable to the specific clients situation. These checklists can link out to SEC regulations and SEC filings.These checklists have links to SEC regulations in SEC filings and comment letters.

There has been an explosion of litigation analytics products over the past three years… Not so much on the transactional side. LexisNexis has invested heavily in their litigation analytics products Lex Machina and Context (formerly RavelLaw). Lexis is not the first legal publisher to offer transactional analytics but they now have the most advanced product in that niche. Bloomberg Law ‘s Draft Analyser and Wolters Kluwer two transactional clause analytics products preceded Intelligize in the transactional analytics space. I can only hope that competition in transactional analytics market will follow the same upward trajectory as the litigation analytics market.