Litera today released a new product that uses generative artificial intelligence to create a database of corporate deal terms from a law firm’s own documents, in order to give legal teams easy access to al relevant data points from prior transactions, whether for negotiating a deal or pitching a potential client.

The product, Foundation Dragon, creates a searchable collection of some 300 relevant data points from unstructured data found in closing documents for M&A, real estate, finance and other types of deals, including all matter, deal and negotiating data.

“Foundation Dragon is a revolutionary new product that we’re launching which helps to automatically extract deal points from final closing documents to populate an insight and experience database based on the closing positions that have been agreed in the documents,” Adam Ryan, Litera’s head of product, told me during a demonstration yesterday

For law firms, the product’s primary use cases are twofold:

- In negotiating deals, when legal professionals want to identify relevant market terms and prior examples. “If you’re working on a transaction against an opposing counsel and your client asks you what’s the market position for this particular type of issue, what you’re able to do is go into the insights database and, through a series of visualizations, see what’s market on that particular type of deal point,” Ryan said.

- In business development, when firms want to demonstrate their experience with particular types of deals or in particular jurisdictions. “If a client is looking for experience in a particular type of transaction with a particular type of asset in a particular type of jurisdiction, you’re able to use this platform to go and find that information and more effectively market your services,” he said.

A third possible use case, Ryan said, is to support thought leadership by enabling professionals to identify M&A trends and issues.

“By leveraging AI to perform this highly manual work, Litera is seamlessly combining two valuable data sets – deal terms and experience – and making this data accessible to more firms than ever before,” Ryan said. “Our goal at Litera is to leverage AI across all of our products in a practical way that enhances the user experience.”

Developed In Collaboration with Firms

Litera, which acquired the Foundation firm intelligence platform in 2021, said it developed the product in collaboration with several law firms that have been long-time Foundation customers, including Frost Brown Todd LLP and Goodwin, in order to identify the most crucial deal points for Dragon to extract.

“Dragon goes beyond traditional manual-entry deal term databases by extracting and aggregating a firm’s deal intelligence and marrying it with experience data via Litera Foundation, enhancing accuracy and productivity compared to manual review and data entry by attorneys,” the company said.

For law firms, Litera says, the product offers several benefits, enabling them to:

- Turn their collective experience into quantifiable insights that enhance the value they deliver clients.

- Automatically extract relevant precedents, deal points, and insights on opposing counsel from their documents, including seeing what a counterparty’s counsel has agreed to in the past.

- Make it easy for lawyers to find deal precedents comparable to current deals and, unlike manual databases, ensure the data is always up to date.

- Minimize the cost and effort of creating and maintaining a deal point database.

- Negotiate more strategically by leveraging historical data.

How It Works

The product has two components, one for uploading deal documents and another for exploring and searching the accumulated deal data.

When a firm uploads a document, it first selects the type of deal and the client number from the firm’s practice management system. The AI then goes through and extracts the key deal points. It can extract up to 300 deal points, including those identified by the American Bar Association in its M&A deal points study.

“It is taking an agreement, chunking up that agreement into different clauses, understanding and classifying the clauses, and then extracting the relevant deal points directly out of the document itself,” Ryan said. “So this is the real power and the magic of the platform.”

Firms have told him that this same extraction process could take an associate 8-10 hours to complete.

Dragon takes only moments to show the deal points, arranged in a table. The table is side-by-side with the uploaded document, and each deal point aligns with the source of that point within the document, so the accuracy of the AI’s extraction as to each point can be verified.

In the piloting of this product so far, Ryan said, some firms are going through and verifying each extracted point, while others have found the extraction so accurate that they do not feel the need to verify each point.

This uploading is done manually, and Ryan said firms in the product’s pilot have developed a workflow of routinely uploading documents at the conclusion of a deal.

Database of Deals

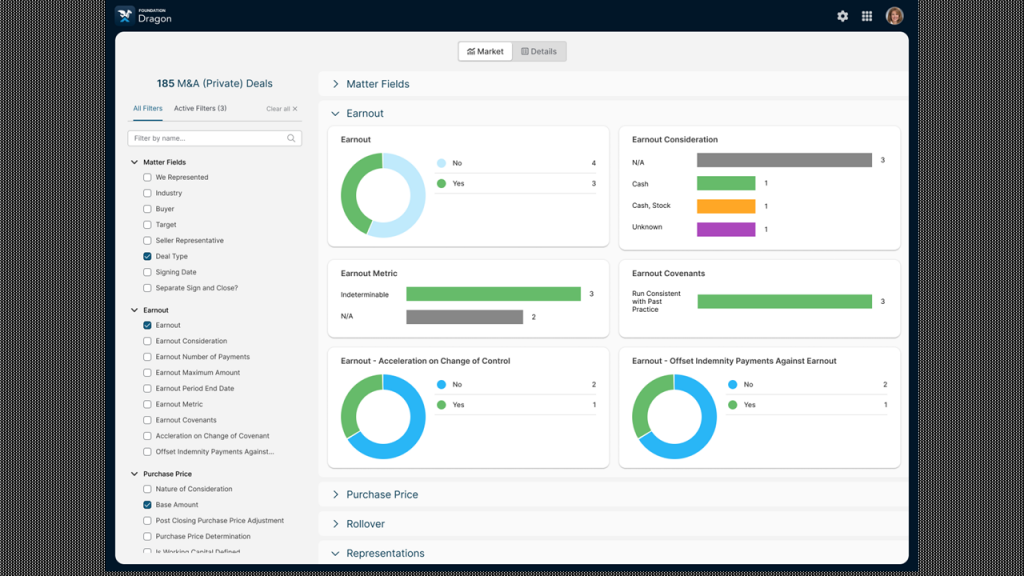

The second part of the platform is a dashboard from which firms can search and explore their database of deals. Charts enable firms to see visualizations of market trends within their deal documents, including by party names, industries, deal types, and specific provisions.

Users can search and filter to drill down to any specific deal point or to specific parties, law firms or even attorneys. Finding prior deals involving the counter-party’s same attorney can be persuasive in showing prior agreement to disputed points.

If a firm wanted to see, for example, how many of its prior deals included an earn-out provision, the dashboard will show it how many deals did or did not include that and enable the user to drill down to further filter and compare the results or view the actual agreements via links to the firm’s document management system.

“What you’re able to do is use these filters to get to a very specific set of transactions,” Ryan said. “And then what you’re able to then do is compare each of those transactions that you want to look at side by side, and then you’re able to look and see the difference in each of the transactions.”

Unlocking Experience

I asked Ryan how this product compares to contract lifecycle management products that use generative AI to extract key contract terms and make that data available for contract drafting and review.

Key differences for Dragon, he said, are the granularity of the deals points being extracted, the design of the product for the specific use cases of business development and deal negotiation, and the fact that it is part of the Foundation platform and benefits from the various security controls that are built into that platform.

“We know that it adds tremendous value to the firm because, at the end of the day, law firms’ core intellectual property is the people that they have working for them and the experience and the knowledge that they built up during their practice,” Ryan said.

“What this platform does is unlock that experience and that knowledge of prior transactions for the firm to be able to use in a variety of different use cases, so we think this is going to be really transformative for how law firms do a variety of processes.”